How to create a formal bank letter?

Here, we will provide a comprehensive guide on how to write a formal bank letter from bulk, including all the necessary information you need to know. Before starting, you can check our 🔗 letter format to learn more about the business letter format.

- Include a subject line: This should clearly state the letter's purpose. For example, "Request for Bank Statement," "Authorization Letter for Account Closure," or "Reference Letter for Account Opening."

- Address the recipient correctly: In our samples, we address the recipient in general, such as "To Whom It May Concern" or "Dear Sir/Madam," to simplify. However, if you have the recipient's information, we highly recommend addressing their name in your letter. Our document generation system allows you to edit the text freely before downloading your personalized document.

- Explain the letter's purpose: When writing a letter to the bank, you can start the letter's intent from the beginning briefly, such as closing an account or requesting a stop payment.

- Provide bank account details: If necessary, include specific details such as dates, amounts, or account numbers on the written letter so the receiver can check and take prompt action in your matter. For security reasons, remember not to write this information into your email to prevent hackers.

- Attach relevant documents: If this is an urgent request, check the bank's requirement to attach supporting documents to speed up the process, such as a copy of your ID or bank statements.

- Close the letter: Thank the recipient for their time, and include your email, phone number to get in touch, and your signature. Before sending the letter, ensure all information is accurate and complete by reviewing it carefully for any errors or typos.

Related Post

In some cases, if you are requesting a loan or mortgage, the bank may request a 🔗 verification letter to inspect your financial status. You can create a professional letter with just a few clicks with us.

letter to bank templates

Several types of bank letters are commonly used, such as requests for bank statements, bank reference letters, bank closure account letters, stop payment letters, etc. Each type of bank letter serves a different purpose and requires specific information. Let's make your letter with our document generator.

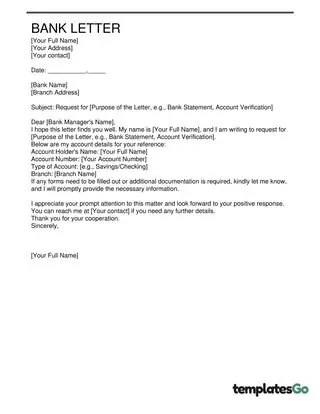

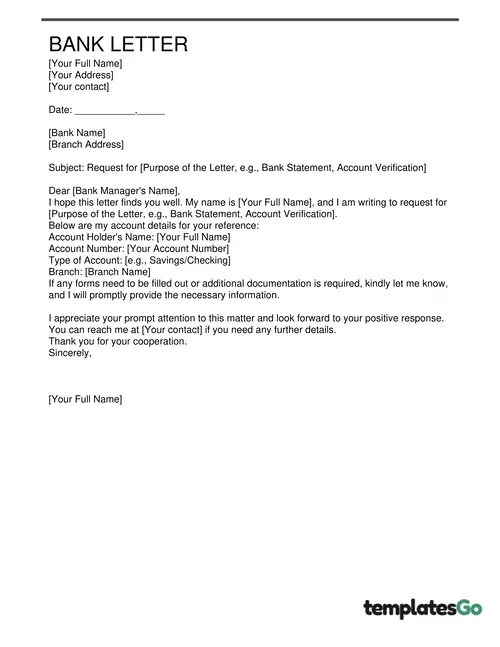

Simple Bank Letter

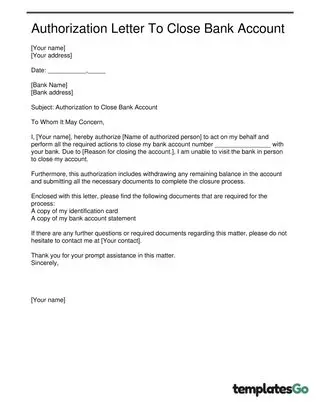

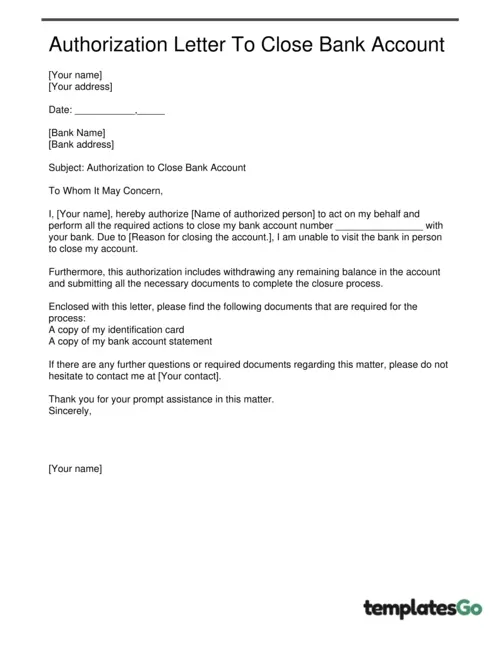

Authorization Letter To Close Bank Account

Related Post

Quickly generate a free 🔗 authorization letter by personalizing our editable templates for a prompt and tailored result.

As these letters are formal documents that need time and effort to write, we offer a variety of customized templates for specific cases, which you can conveniently select and follow three simple steps to create your letter:

- Choose one of our professional templates you need.

- Fill in your information by answering our simple questions.

- Review the bank letter. You can adjust the text before and after downloading this document.

More Bank Letter Templates To Explore

Below is a list of the most commonly required bank letters for your reference you can find our editable templates 🔗at the end of the article.

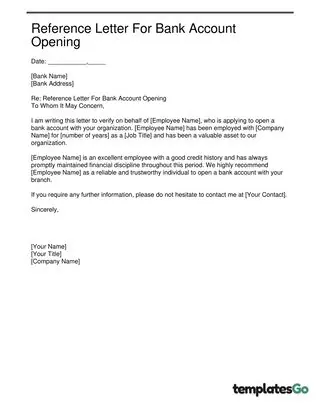

Company Reference Letter For Bank Account Opening

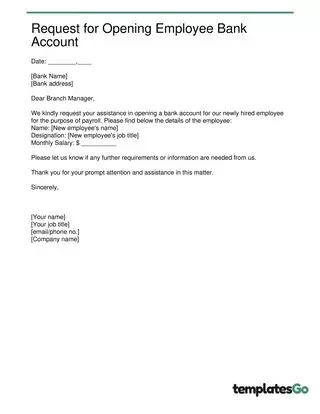

Request for Opening Employee Bank Account

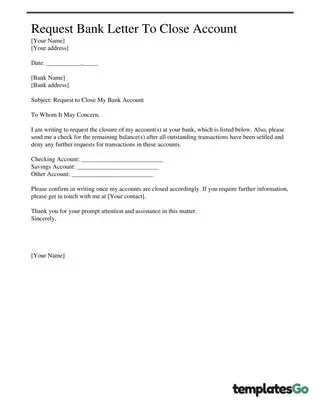

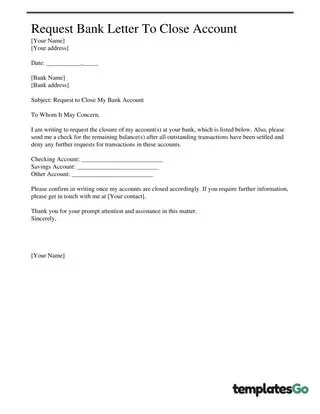

Bank Letter to Close An Account

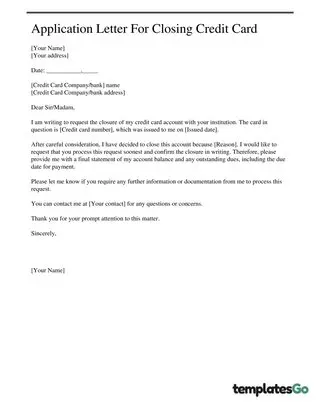

Letter To Cancel A Credit Card

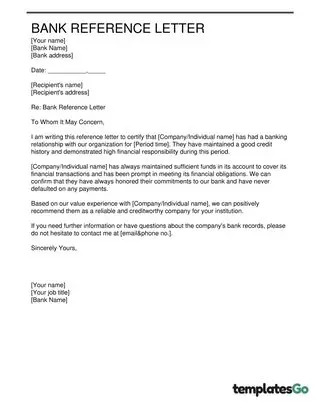

Bank Reference Letter

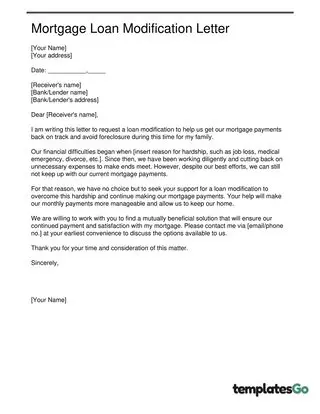

Mortgage Loan Modification Letter

Business Letter To Request For Loan

Request Letter For Bank Statement

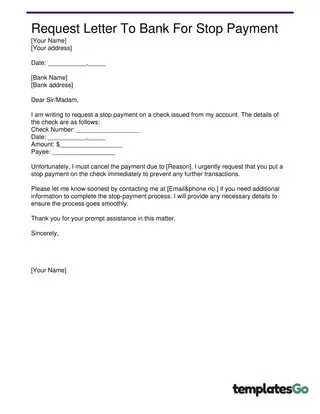

Request Letter To Bank For Stop Payment

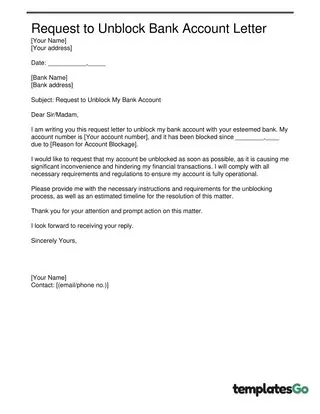

Request to Unblock Bank Account Letter

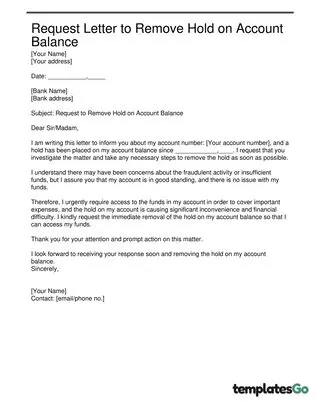

Request Letter to Remove Hold on Account Balance

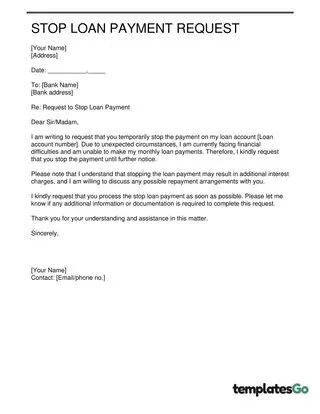

Stop Loan Payment Request

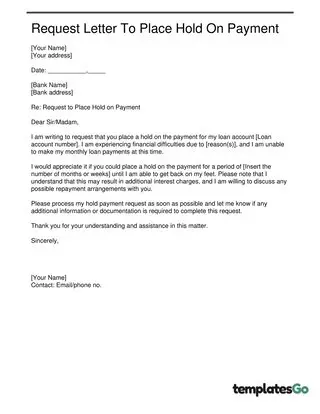

Request Letter To Place Hold On Payment

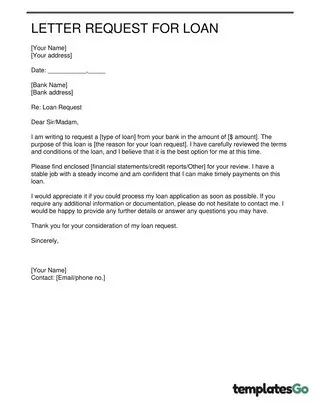

Letter Request For Loan

What are the common reasons you can request a loan?

Our template uses the common purpose of requesting a loan for further expansion and business development. However, you can customize this template with your reasons. Here is a list of potential purposes for requesting a loan as a reference:

| Reasons to Request a loan for Individual | Reasons to Request a loan for Business |

|---|---|

| - Home improvement or renovation. - Purchasing a vehicle or other large asset. - Paying off high-interest debts such as credit card balances. - Covering unexpected medical expenses. - Financing a wedding or other major life event. - Starting or expanding a small business. - Paying for education expenses such as tuition or student loans. - Funding vacation or travel plans. - Making a large investment, such as in real estate or stocks. | - To buy commercial real estate. - To buy equipment. - To buy inventory. - To increase working capital. - To hire more employees. - To finance marketing campaigns. - To attract top talent. - To relocate your office. - To open additional offices in a new area. - To purchase business insurance. - To merge with or acquire another company. - To buy out shareholders. - To establish credit for a future larger loan- |

Related Post

We also have 🔗financial hardship letter templates for other cases, such as College Aid, Auto Loans, etc., you can edit immediately on our platform to help you request assistance from the creditors.