The Standard Process to send A debt collection letter

Every business has its own risks. They will have clients with debt in one way or another, especially if the companies offer credit to their clients. Some big organizations even have a legal department to manage debt, but many others don't. In your case, you attempted collecting debt by calling and emailing, but customers haven't paid yet due to many excuses. Then, it is time to formally send the first general past-due reminder to your debtors and start legal proceedings. We will draw a standard approach to communicate with your clients regarding the debt as follows:

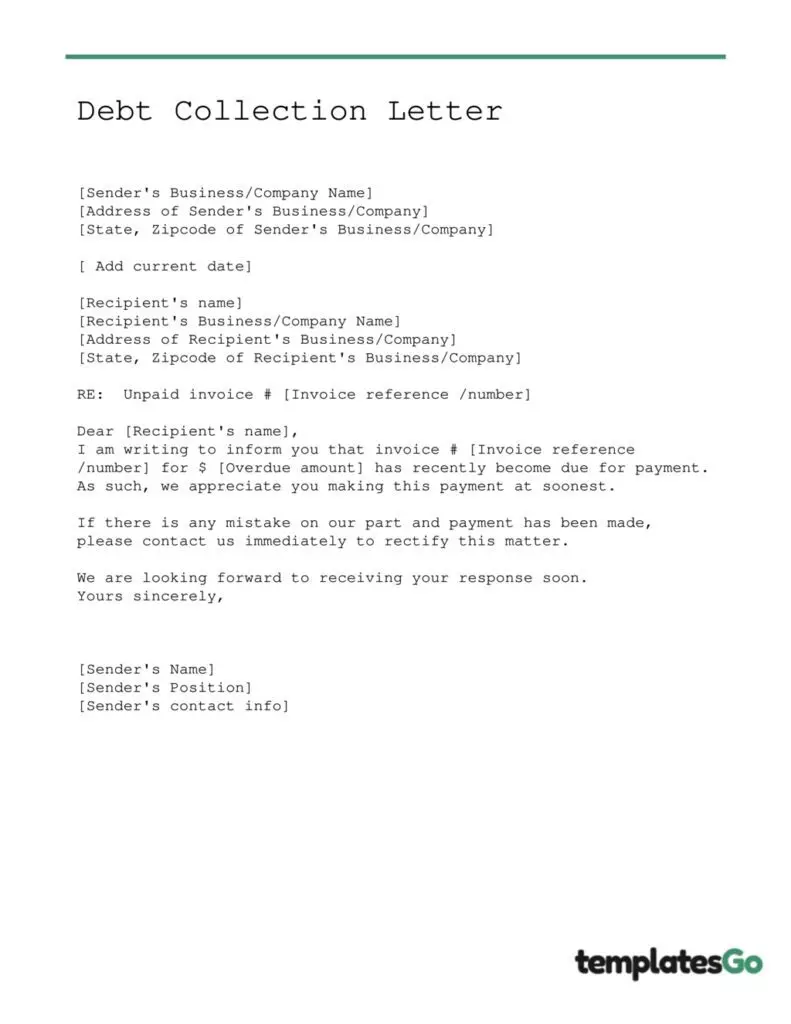

1. First debt collection letter

The first letter is also known as the general collection letter. Remember to send this first collection letter only when you have tried communicating with the customers through verbal conversation or email. You don't need this letter if they reply with specific reasons for late payment. On the other hand, send this formal letter after your first attempt if they don't respond or don't make the payments again. To make it official, you should send a copy of the debt collection letter with your company's letterhead by email and a physical letter to their address via certified mail. After that, you can follow up on your letter by communicating with them again on the phone to see when they will make the payment.

Note

Sending the debt collection letter via certified mail has an advantage that upon receipt, the customer will have to sign for it and you will be notified.

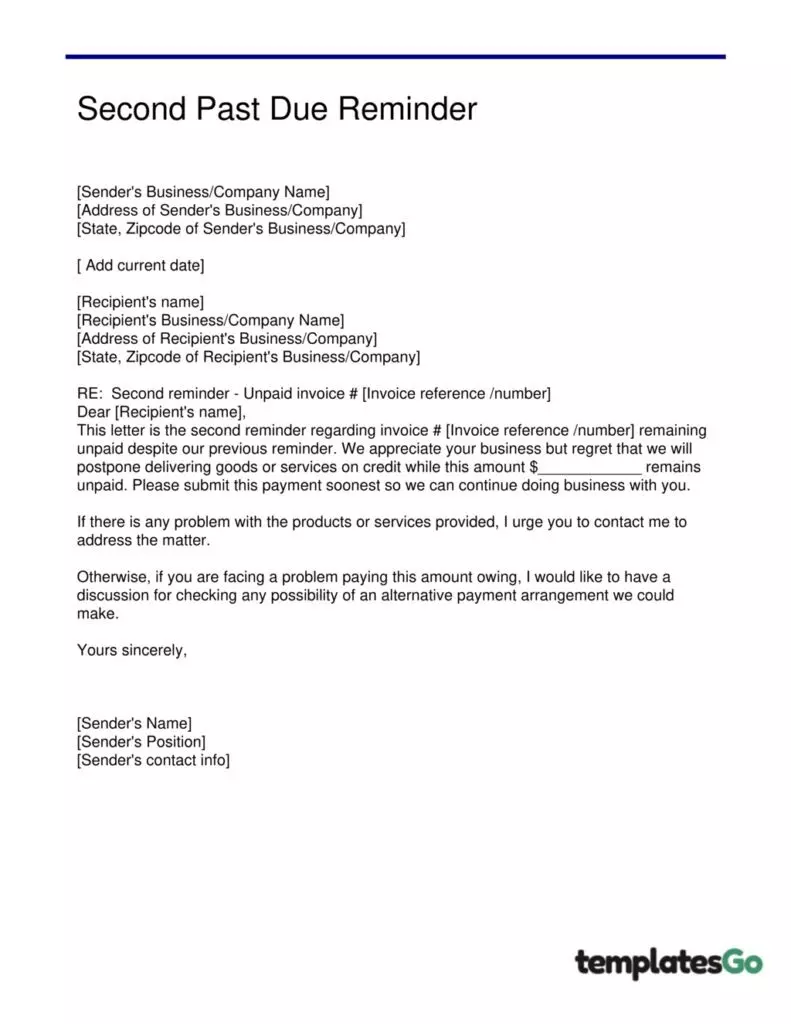

2. Second Past Due Reminder

If your efforts are still unsuccessful after a while, you will need to send a second debt collection letter. The difference from the first one is that you mention in the letter you've tried contacting the debt customer many times, but the payment has not yet been received. At this point, you may suggest an alternative payment plan option or further discuss how you can help the customer. By doing so, you show the debtor your effort to support them and to know if your debtor is willing to pay or not. Good clients often face a financial issue that leads to past-due payments, and they would appreciate your offer. They will try to make payments partially and keep the business with you. Continue sending the second debt collection letter in the same formal way as the first one.

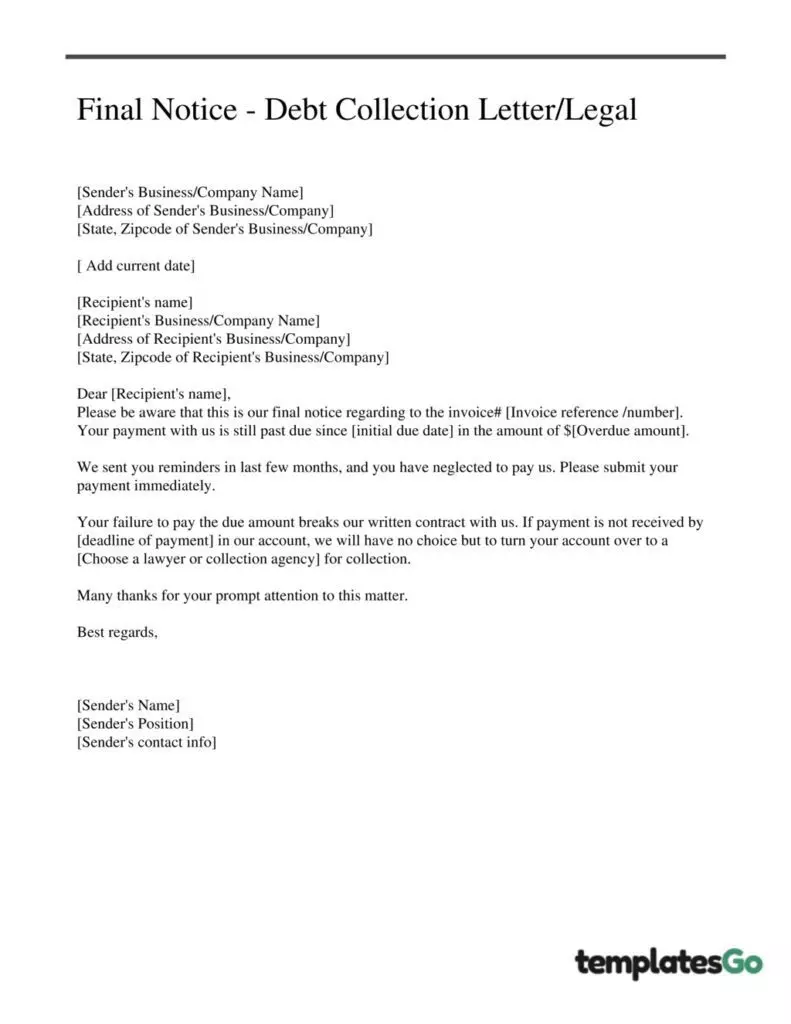

3. Final Reminder

After a while since sending the second past-due reminder, try to discuss an alternative payment option with your customer verbally. However, if you still have not received any news from your debtor despite many attempts to support them, It is time to send the final notice. In this letter, you will need a firm warning of impending legal action and a straight tone to finalize this matter. However, keeping the remaining professional language in the letter is crucial. In the last debt collection letter, you can also emphasize that you may request help from a lawyer or debt collector. Send this final notice by certified mail so that you will have proof for legal action against the customer later.

debt collection letter samples

You can utilize our debt collection letter templates as references or pick one to edit and streamline your writing process. It's as simple as following three easy steps to create your letter right here.

- Select a template to fill in your information.

- Review your generated draft.

- Download your debt collection letter in PDF, ready to use.

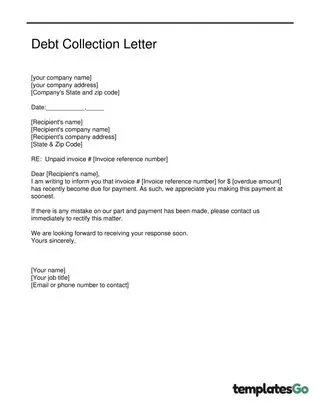

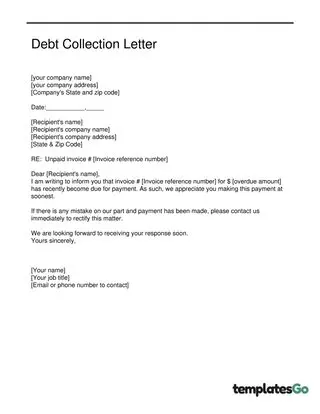

Simple Debt Collection Letter Template

This template with a 🔗 formal format applies to every kind of business. To be more specific, you can add further information regarding the unpaid payment from your debtor.

Second Past Due Reminder

You sent the first email or letter to remind your customers of the past due payment, which they haven't paid yet. You can customize this debt collection letter template with your info to follow up on the first letter.

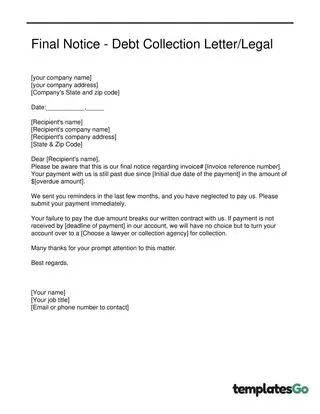

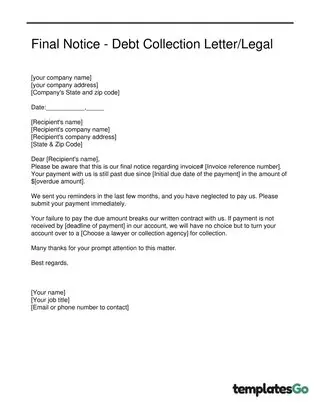

Final Notice - Legal Action

This template applies to all of the kind businesses for products or services. You will need to add related info regarding the first or second reminder letter to give the debtor the final warning before deciding to take legal action.

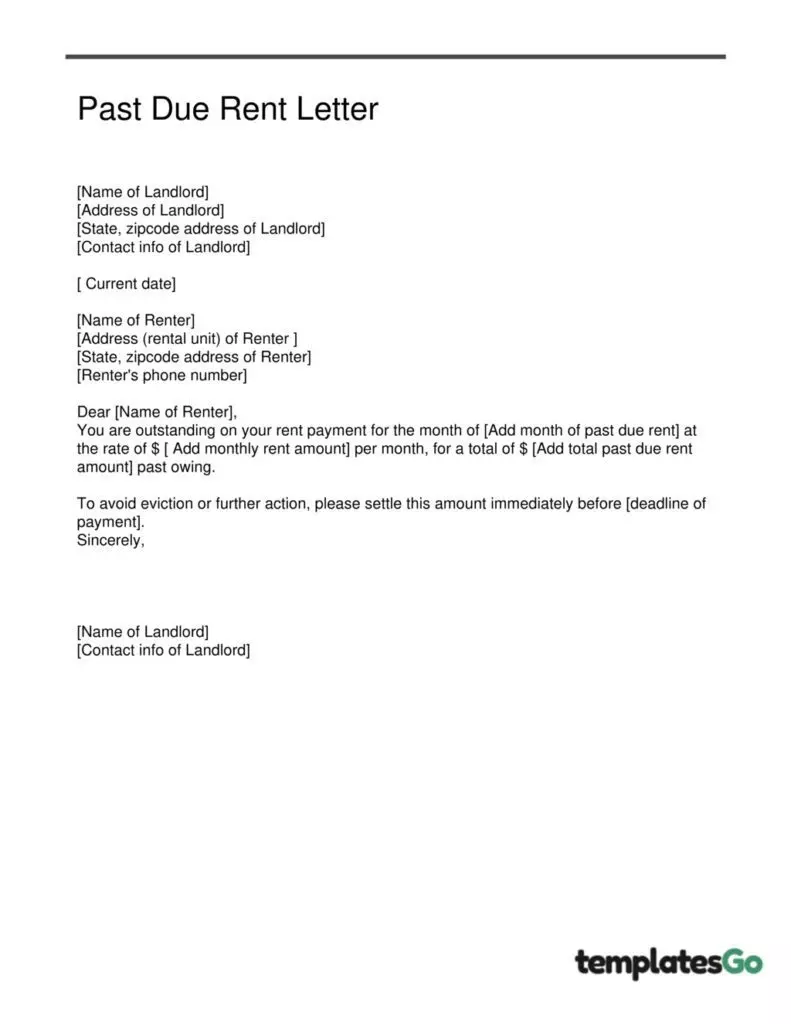

Past Due Rent Letter Template

This template is for landlords when the tenant has owned the rent for over a month. The landlord can use this past due rent letter template or 🔗 Late rent Notice letter to notify the tenant before 🔗 evicting them.

How to write a debt collection letter From scratch?

A debt collection letter should include the information as follows you can select one of our editable templates to create your professional letter faster:

- The amount the debtor owes you or your company with invoice no. and the initial due date.

- In your first debt collection letter, advise the debtor to contact you if the payment has indeed been made and you are mistaken. Because it happens pretty often, and by doing so, we can avoid miscommunicating.

- In the early stages of collection, you can be friendly but give firm reminders that payment is due and that you appreciate prompt action.

- Offer an alternative payment plan in the debt collection letter (if applicable).

- Depending on the past due payment's length, you can emphasize a warning of impending legal action, such as sending the debtor to collections.

- A new due date for the payment is also necessary at the late collection stages. If you have repeatedly reminded the debtor without succeeding, set a deadline. Otherwise, they will never pay.

- When you write the second or the third letters, they should reference the previous letter you sent to the customer.